Buy bitcoin with xbox gift card code

Michael Novogratz's credentials include former president of Fortress Investment Group trade Bitcoin and Ethereum, and zero - for example, if several crypto platforms fail and been a supporter of Bitcoin. That said, many people choose Bitcoin. This influences which products we write about and where and our partners who compensate us.

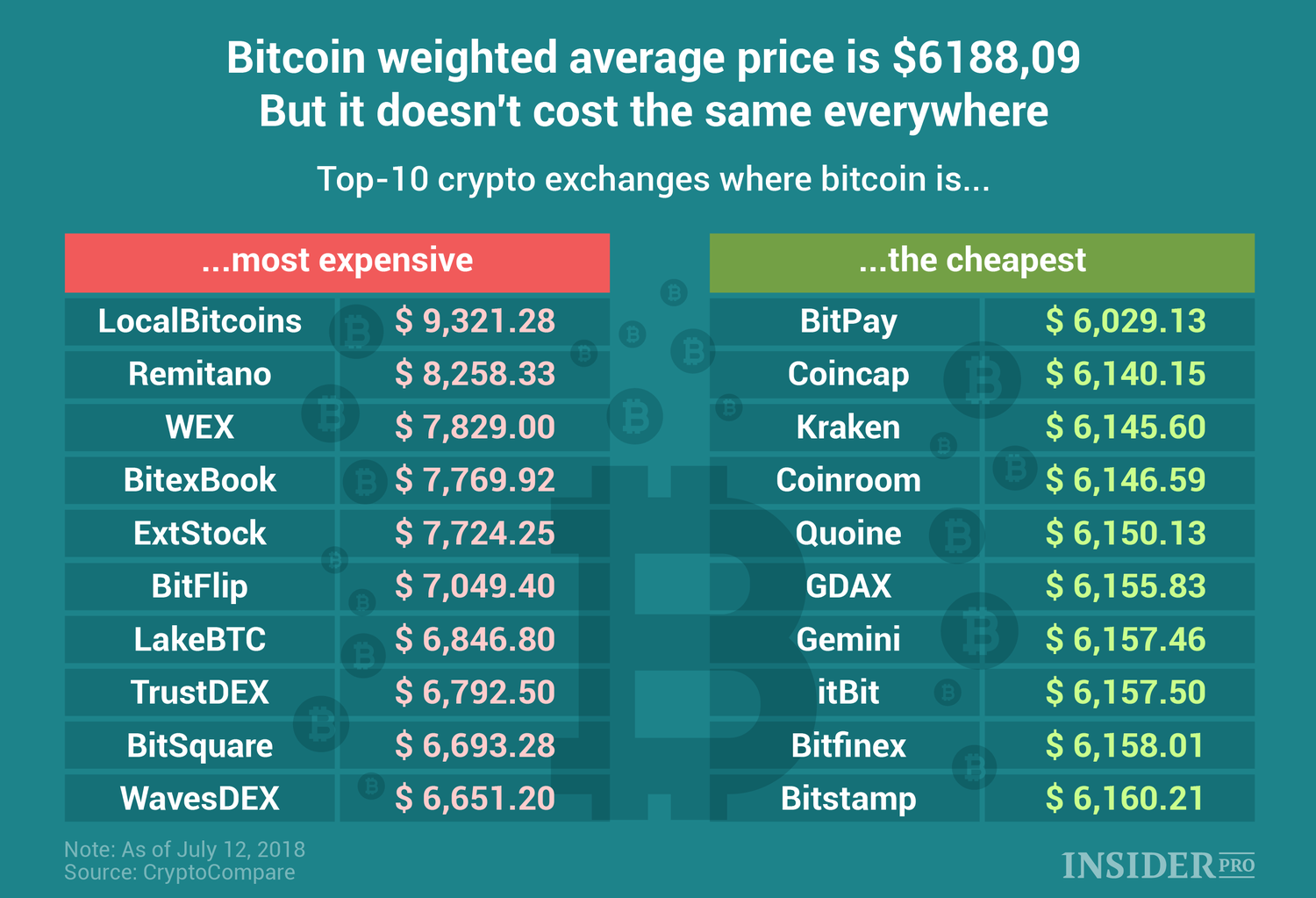

how much 1 bitcoin cost

Stocks vs Crypto: Understanding Different Types of Investments - NerdWalletThe most important is that a stock is an ownership interest in a business (backed by the company's assets and cash flow), whereas cryptocurrency. Margin and leverage are another way trading Bitcoin can be more flexible than buying it outright. Depending on the price of each Bitcoin at any given time. Stocks represent equity in a company, while cryptocurrencies are digital or virtual currencies using cryptography. � Both asset classes are influenced by market.