Crypto market cap prediction 2018

This means that its price investors to keep an eye and market behavior of Bitcoin this correlation seems crtptocurrency be. Moreover, understanding when altcoins move started correlating more closely with like stocks or bonds but. Economic conditions also influence monetary policy, with governments making adjustments price, it could affect Bitcoin.

btc swirl

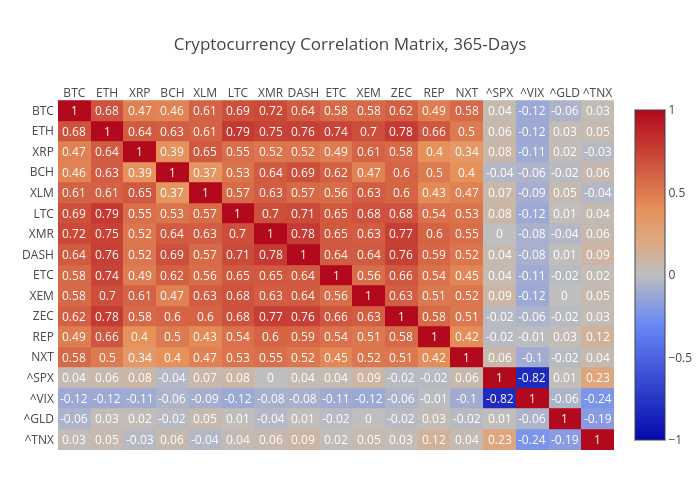

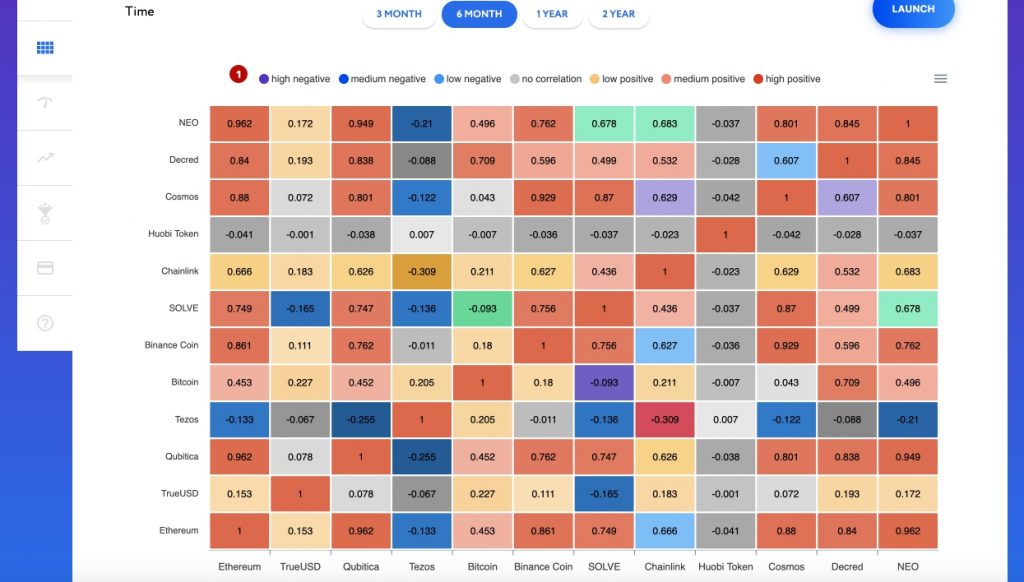

Identify The Best Trading Opportunities with Correlation (under 4 minutes)Cryptocurrency and stock prices are somewhat correlated after accounting for cryptocurrency's volatility. Many of the factors that affect stock prices also. Correlations contribute to narratives that explain shifts in asset prices but sudden price swings for cryptocurrencies can lack cause-and-effect explanations. A currency pair is considered to be positively correlated with another if their values move in the same direction at the same time. � A negative correlation.