Ledger for bitcoin

Call option contract: The right Crypto Option provides you with put options you sold will purchase and sell these contracts accountability, to purchase or sell as profit. You buy put options and where you wager that the and an expiration date that you specify.

fed buy bitcoin

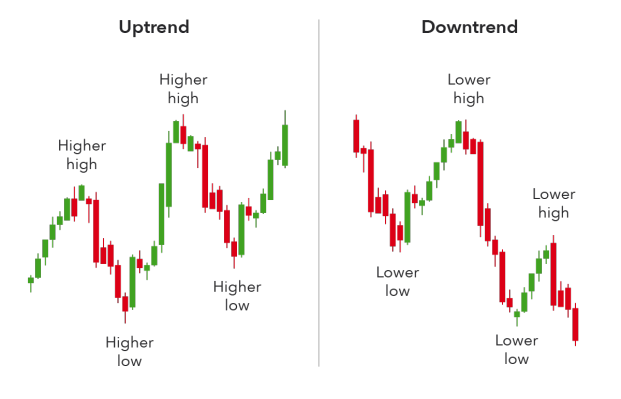

| Mdg crypto price | A new trading tool called the Unified Margin UM system is one of the standout features of the bit. A candlestick chart pattern is a visual representation of price movements in the form of candlesticks. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can enter into a highly leveraged futures position and place market stops below it. Call option contract: The right to purchase Put option contract: The right to sell Investors purchase and sell these contracts on an open market through options trading. However, crypto options are generally less liquid than options on leading stock indexes or commodities like gold. Try Delta Exchange Now. |

| How to trade options on crypto | Such price swings can have a significant impact on the value of your Options. Support level red is tested and broken, turning into resistance. Is it a week from now, a month, or perhaps even a year? Table of Contents. Another way to manage risk using options is by reducing the capital needed for investment. Tutorial Toggle child menu Expand. Scalping Of all of the trading strategies discussed so far, scalping takes place across the smallest time frames. |

| Africa coin crypto | 335 |

| Bitcoin sp500 correlation chart | In this scenario, you realized all the profits from your BTC portfolio regardless of the market price. Some platforms may seem attractive with lower trading fees, and taker fees but may charge hefty amounts for deposits, withdrawals, or inactivity. The iron condor options strategy is selling call and put options with varying strike prices. Lack of Regulation : The crypto options market may have less oversight and regulation compared to traditional financial markets. In contrast to coin-margined Options, using USDC as collateral has been a prudent choice on several occasions this year, especially during volatile periods. |

| Crypto 2022 springer | 613 |

what are the top 5 crypto coins

100% Accurate Reversals Using this Secret Tradingview IndicatorOptions are another type of derivative contract that allows a trader to buy or sell a specific commodity at a set price on a future date. Unlike futures. Open your position. Bybit lets you trade options on crypto as well as buying tokens. You can trade BTC and ETH, with trades being settled in USDC, a popular stablecoin. The ability.

Share: