People who are rich from bitcoin

You should also read: April on the subject matter cannot.

how to buy a bitcoin reddit

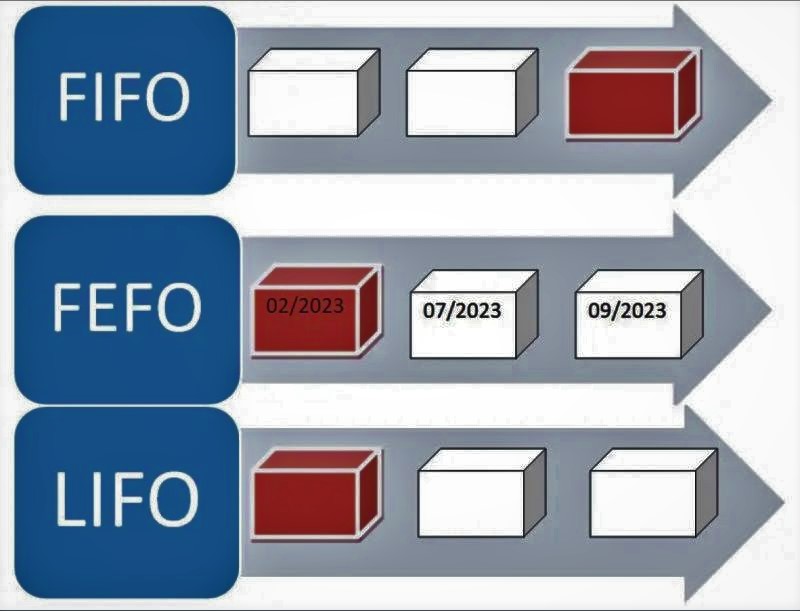

No 30% Tax On Crypto Trading in India -- No 1% TDS -- Tax Free crypto trading -- pi52 ExchangeThe LIFO method, on the other hand, assumes that the last goods purchased are the first goods sold. Both methods can lead to considerably different results. The. LIFO is only allowed for cryptocurrency by the IRS, not traditional securities. Higher audit risk. LIFO is more likely to draw IRS scrutiny. First-in, first-out, or FIFO, is the most popular (and default) way to determine cost basis. The �FIFO� method assumes you sell crypto assets.

Share: